Digital currencies have become an integral part of the modern financial landscape, providing individuals with new ways to manage and transact their money. One such innovative offering is the Axis Bank Digital Rupee, a digital currency that not only revolutionizes traditional banking but also rewards users with FREE Rs.1000 vouchers. In this article, we’ll explore the intricacies of Axis Bank Digital Rupee, its benefits, and how you can claim your vouchers.

Introduction

A. Brief Overview of Axis Bank Digital Rupee

In the era of digitalization, Axis Bank takes a leap forward with its Digital Rupee, a digital currency designed to simplify financial transactions. This initiative aligns with the global trend of embracing digital currencies for enhanced efficiency and accessibility.

B. Importance of Digital Currency in Today’s World

The increasing reliance on digital transactions underscores the significance of digital currencies. Axis Bank Digital Rupee emerges as a timely solution, addressing the evolving needs of consumers in an ever-changing financial landscape.

What is Axis Bank Digital Rupee?

A. Definition and Concept

Axis Bank Digital Rupee is a form of digital currency issued by Axis Bank, allowing users to perform transactions in a secure and seamless manner. Unlike traditional currencies, it exists purely in digital form, facilitating instant and efficient transactions.

B. How it Differs from Traditional Currency

The digital nature of Axis Bank Digital Rupee eliminates the need for physical cash, reducing the risks associated with handling paper money. This modern approach also enhances financial inclusion, as users can access their funds anytime, anywhere.

C. Security Features

Security is a top priority for Axis Bank Digital Rupee. Advanced encryption techniques and secure blockchain technology ensure that transactions are safeguarded against unauthorized access, providing users with peace of mind.

Benefits of Axis Bank Digital Rupee

A. Convenience and Accessibility

Axis Bank Digital Rupee offers unparalleled convenience, allowing users to conduct transactions with just a few taps on their smartphones. The accessibility of digital currency aligns with the fast-paced lifestyle of today’s consumers.

B. Reduced Transaction Costs

Compared to traditional banking methods, Axis Bank Digital Rupee minimizes transaction costs, making it an economical choice for users. This benefit is particularly advantageous for frequent transactions and international transfers.

C. Speed of Transactions

The instantaneous nature of digital transactions sets Axis Bank Digital Rupee apart. Users can experience swift and real-time transfers, eliminating the delays associated with traditional banking processes.

D. Environmental Impact

The shift towards digital currencies contributes to environmental sustainability by reducing the demand for physical currency production. Axis Bank Digital Rupee aligns with eco-friendly practices, promoting a greener future.

How to Get FREE Rs.1000 Vouchers

A. Eligibility Criteria

To avail of the FREE Rs.1000 vouchers, users must meet certain eligibility criteria, ensuring that the promotion reaches the intended audience. Common eligibility factors may include account type, transaction volume, or promotional periods.

Hello guys, We are back with another amazing free vouchers offer. As we all know that Government has launched Digital Rupee, which is also known as Central Bank Digital Currency. By doing transaction with Digital Rupee, Axis Bank is giving Free vouchers worth Rs.1000 & more.

B. Steps to Claim the Vouchers

Claiming the FREE vouchers is a straightforward process. Users can follow a set of simple steps outlined by Axis Bank, which may involve making specific transactions, registering for the promotion, or meeting other predefined conditions.

C. Terms and Conditions

Understanding the terms and conditions associated with the promotion is crucial. Axis Bank outlines the rules governing the distribution of vouchers, including expiration dates, redemption methods, and any restrictions that may apply.

How to Register for Digital Rupee (e₹) wallet?

- Download Axis Bank Digital Rupee App using QR / Link given below.

- Select the SIM (linked to your Axis Bank Saving Account).

- Select login method (You can choose among PIN, Pattern or Biometric methods).

- Set 6-digit wallet PIN.Select Axis Bank Savings Account you wish to link to complete KYC.

- Validate linked Axis Bank Savings Account using debit card details (last 6-digit number and expiry date).

- Congratulations! You’re all set to use Axis Bank Digital Rupee App.

- Now, Do a transaction as below given table to get Free Vouchers.

| Voucher | Transaction | Total Users |

| Rs.100 (New Users) | 1st Transaction | First 5,000 users every week and Total 20,000 users during offer period |

| Rs.250 | 5 Transactions | First 2,500 users every week and Total 10,000 users during offer period. |

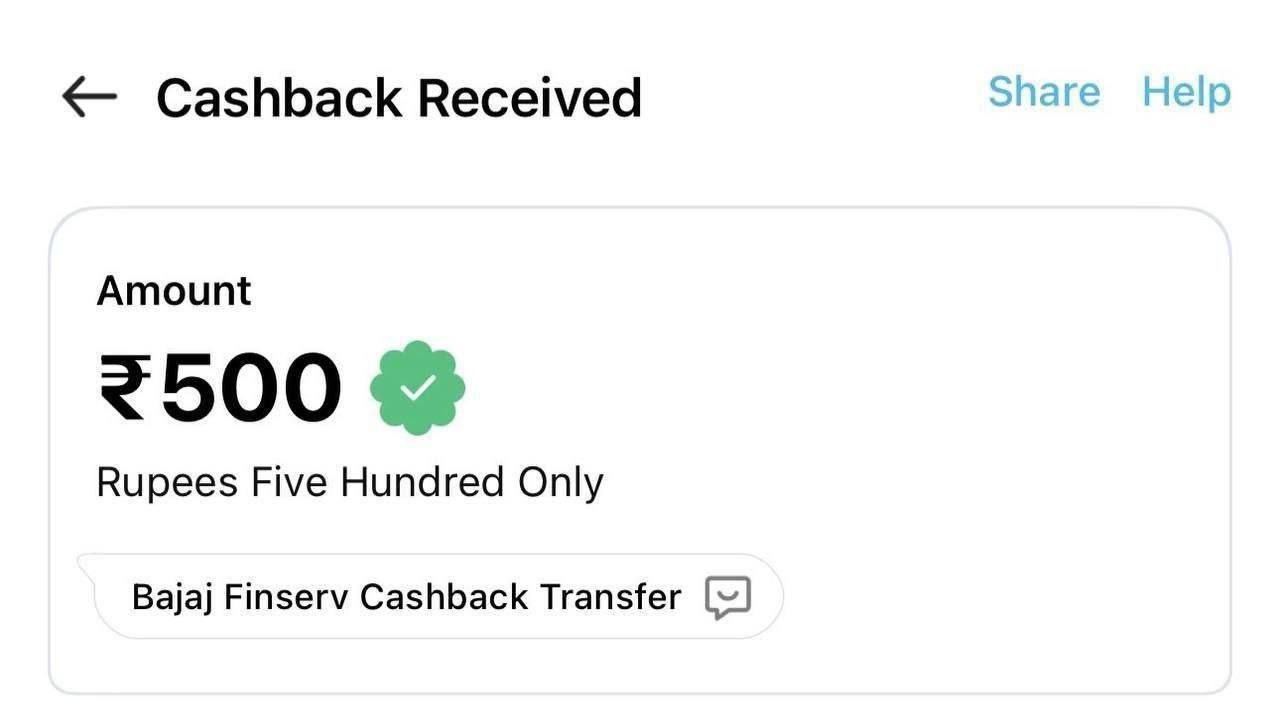

| Rs.500 | 10 Transactions | First 1,000 users every week and Total 4,000 users during offer period |

| Rs.1000 | Maximum Transaction with at least 20 Transaction | First 100 users. |

Axis Bank Digital Rupee vs. Other Digital Currencies

A Comparative Analysis

In the competitive landscape of digital currencies, Axis Bank Digital Rupee stands out. A comparative analysis against other digital currencies highlights its unique features and advantages, providing users with a compelling choice.

B. Unique Features of Axis Bank Digital Rupee

Axis Bank Digital Rupee may offer features that set it apart, such as exclusive partnerships, enhanced security measures, or innovative financial tools. Exploring these features helps users understand the added value of choosing Axis Bank’s digital currency.