Online Application -

You can apply for an SBI credit card in the following ways:

- Online Application: You can apply for an SBI credit card through the SBI website or by visiting the online credit card application portal. Here’s how to apply for an SBI credit card online:

- Go to the SBI website and select the “Credit Cards” option from the menu.

- Choose the credit card you want to apply for and click on the “Apply Now” button.

- Fill in the required details such as your name, date of birth, mobile number, and email address.

- Upload the required documents such as your identity proof, address proof, and income proof.

- Review and submit the application form.

Offline Application:

You can also apply for an SBI credit card offline by visiting your nearest SBI branch. Here’s how to apply for an SBI credit card offline:

- Visit the nearest SBI branch and request for a credit card application form.

- Fill in the required details such as your name, date of birth, mobile number, and email address.

- Submit the application form along with the required documents such as your identity proof, address proof, and income proof.

What's the use of all credit cards?

Credit cards are a type of payment card that allows you to borrow money from a financial institution, such as a bank, to make purchases or pay bills. Here are some of the benefits of using a credit card:

- Convenience: Credit cards offer a convenient way to pay for goods and services. You don’t need to carry cash or write a check, and you can use your card for online purchases or over the phone.

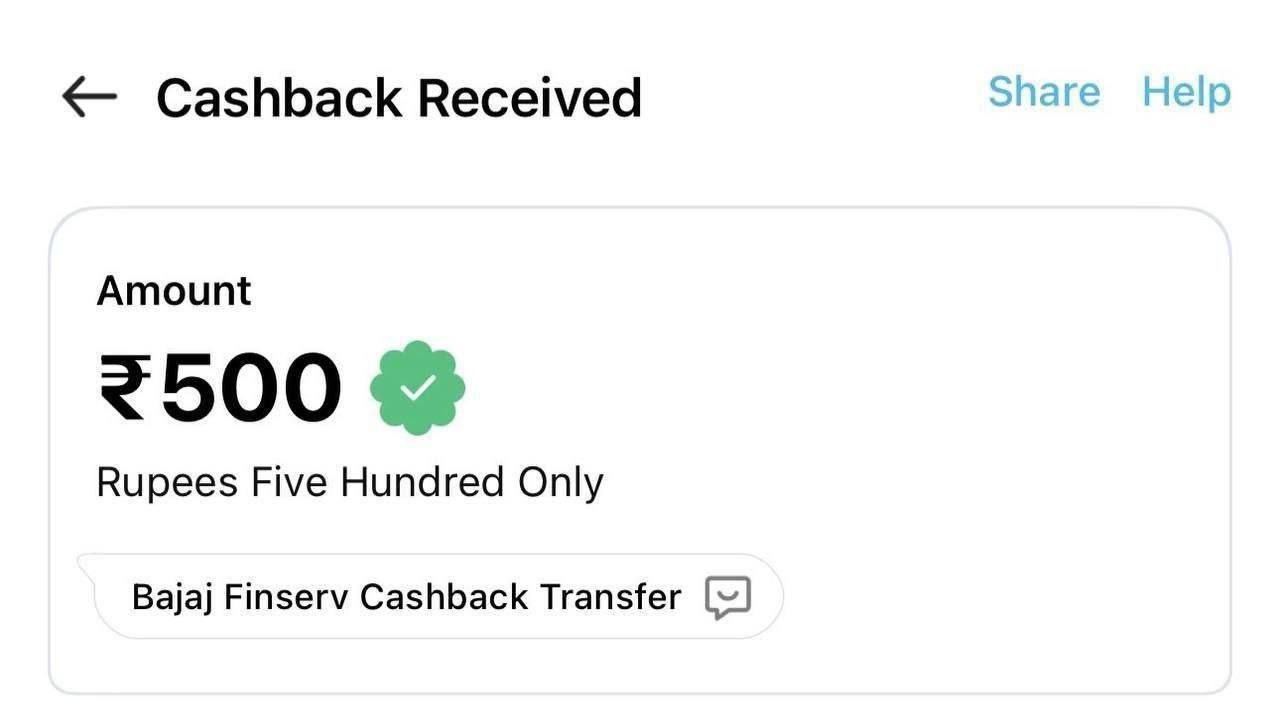

- Rewards and Cashback: Many credit cards offer rewards and cashback programs. These programs give you points or cash back for making purchases, which you can redeem for travel, merchandise, or statement credits.

Build Credit Score: Credit card use can help you build a good credit score, which can be useful when applying for loans, mortgages, or other credit products in the future. When you use your credit card responsibly and make your payments on time, it demonstrates your creditworthiness to lenders.

Fraud Protection: Credit cards offer fraud protection, which means that you are not liable for fraudulent charges made on your card. If someone steals your card information and makes unauthorized purchases, you can dispute the charges and have them removed from your account.

Access to Credit: Credit cards can give you access to credit when you need it. If you have an unexpected expense or emergency, a credit card can provide you with the funds you need to pay for it.

Overall, credit cards can be a useful tool for managing your finances and making purchases. However, it’s important to use your credit card responsibly, make payments on time, and avoid carrying a balance that accrues high interest charges.