Discover the benefits of the SBI Simply Click Credit Card – a powerful financial tool that offers a range of rewards and perks. Get insights into its features, eligibility criteria, application process, and frequently asked questions. Unlock a world of opportunities with this credit card!

In today’s fast-paced world, credit cards have become an indispensable tool for managing finances, offering convenience, flexibility, and rewards. Among the myriad options available, stands out as a compelling choice for individuals seeking a balance between affordability, benefits, and usability. This comprehensive guide will take you through all you need to know about the from its features and benefits to how to apply and make the most of it.

Read More, Best 5 Shopping Credit Cards in India

SBI Simply Click Credit Card: Exploring Its Features

The SBI Simply Click Credit Card lives up to its name by offering a plethora of features that cater to various aspects of modern living. Let’s delve into some of its standout offerings:

Online Shopping Delights

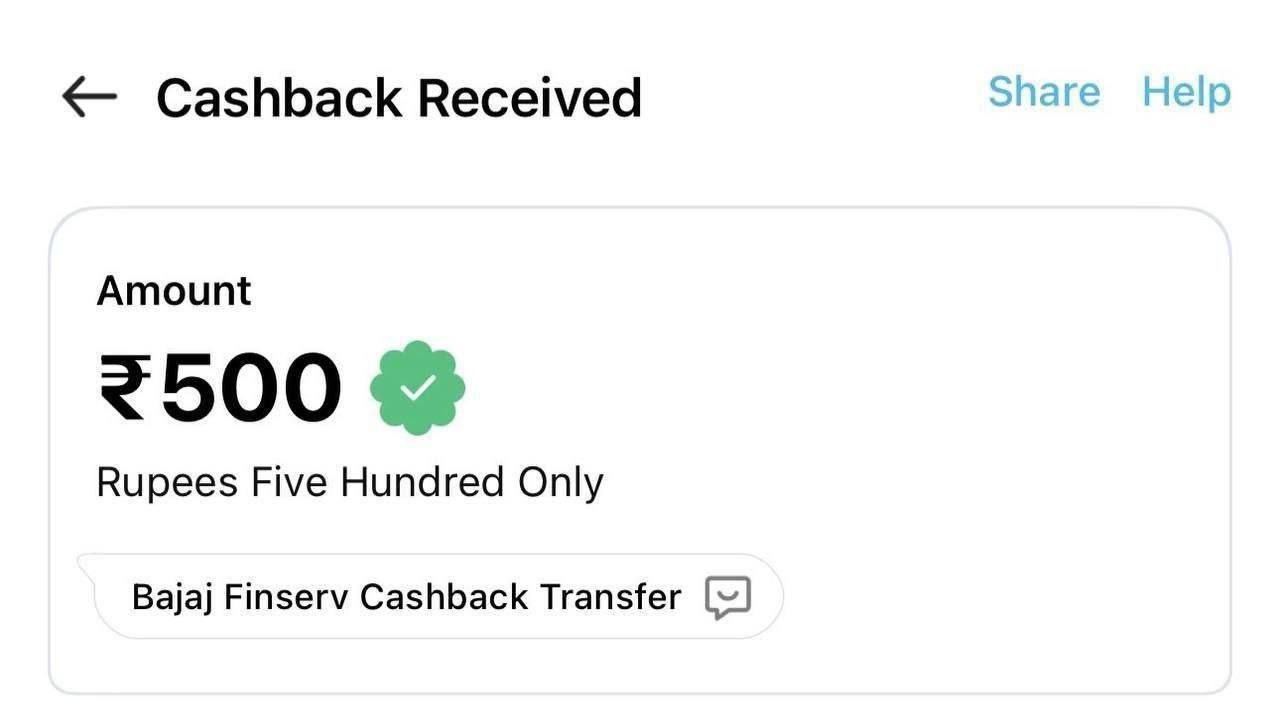

Enhance your online shopping experience with this credit card’s exclusive tie-ups with leading e-commerce platforms. Enjoy attractive discounts, cashback, and reward points on your favorite brands.

Reward Points Multiplier

Earn reward points not just on your online purchases but also on your regular expenses. The card comes with a reward points multiplier that lets you accumulate points faster, allowing you to redeem them for a wide range of products and services.

Entertainment Extravaganza

Movie buffs and entertainment enthusiasts are in for a treat with the SBI Simply Click Credit Card. Avail of complimentary movie tickets and discounts on popular entertainment platforms, making your leisure time even more enjoyable.

Travel Benefits

For those bitten by the travel bug, this credit card offers travel benefits like fuel surcharge waivers, discounts on flight and hotel bookings, and access to airport lounges. It’s the perfect travel companion that enhances your journeys.

Contactless Payments

Experience the convenience of contactless payments with the SBI Simply Click Credit Card. Simply tap your card to make payments securely and swiftly, adding a layer of ease to your transactions.

Applying for the Simple Steps

Getting your hands on the straightforward process that involves a few simple steps:

Check Eligibility: Ensure you meet the eligibility criteria, which generally include age, income, and credit score requirements.

Collect Documents: Gather the necessary documents, including identity proof, address proof, and income documents.

Online Application: Visit the official SBI website or app and fill out the online application form. Provide accurate details to expedite the process.

Document Submission: Upload the required documents as per the guidelines provided during the application.

Verification: Once your application is submitted, the bank will initiate the verification process. This may involve a representative contacting you for further details.

Approval and Issuance: Upon successful verification, your credit card application will be approved, and your card will be issued.

Activation: Follow the instructions provided to activate your card, usually through a phone call or online activation portal.

FAQs about

What are the eligibility criteria?

The eligibility criteria may vary, but typically include age between 21-60 years, a steady source of income, and a good credit score.

Can I apply for this credit card if I already have another SBI credit card?

Yes, you can apply for multiple SBI credit cards, including the SBI Simply Click Credit Card, as long as you meet the eligibility requirements.

Is there an annual fee?

Yes, there might be an annual fee associated with the card. However, some banks offer waiver of the annual fee based on your spending pattern.

How do I earn reward points?

You can earn reward points by using your various transactions. Online purchases often yield higher reward points.

What is the validity period for the reward points?

The reward points earned with the typically have a validity of 2 to 3 years, depending on the bank’s policies.

Can I convert my purchases into EMI using this credit card?

Yes, many transactions made using can be converted into easy EMIs, providing you with flexibility in repayment.

Conclusion

The SBI Simply Click Credit Card is more than just a financial tool; it’s a gateway to a world of rewards and experiences. From earning reward points on online shopping to enjoying entertainment perks and travel benefits, this credit card is designed to cater to your modern lifestyle. With its user-friendly application process and impressive features, the SBI Simply Click Credit Card is a valuable addition to your wallet. So, if you’re looking for a credit card that offers both convenience and excitement, look no further – the SBI Simply Click Credit Card has got you covered.